High market volatility was a major concern for traders and investors in the crypto space. USDT, the largest stablecoin by market cap, has been a stable form of cryptocurrency for almost a decade.

The high liquidity of USDT on major crypto exchanges allows you to exchange it with other cryptocurrencies instantly. You can also use USDTs to participate in various activities like trading, staking, or swapping on numerous crypto platforms.

Tether token created a new milestone in the crypto ecosystem while surpassing a $100 billion market cap in March 2024. USDT is the first stablecoin to achieve this benchmark.

What is Tether (USDT)?

Tether (USDT) was introduced in 2014 to provide a steady form of cryptocurrency that maintains a value of $1. Fiat reserves back this stablecoin and continuously mimics the price of the U.S. dollar, even during highly volatile markets.

Tether was initially issued through the Omni layer protocol on the Bitcoin blockchain. At present, USDT is a multichain stablecoin that simultaneously exists on various blockchains, such as Ethereum, Solana, EOS, Tron, and more.

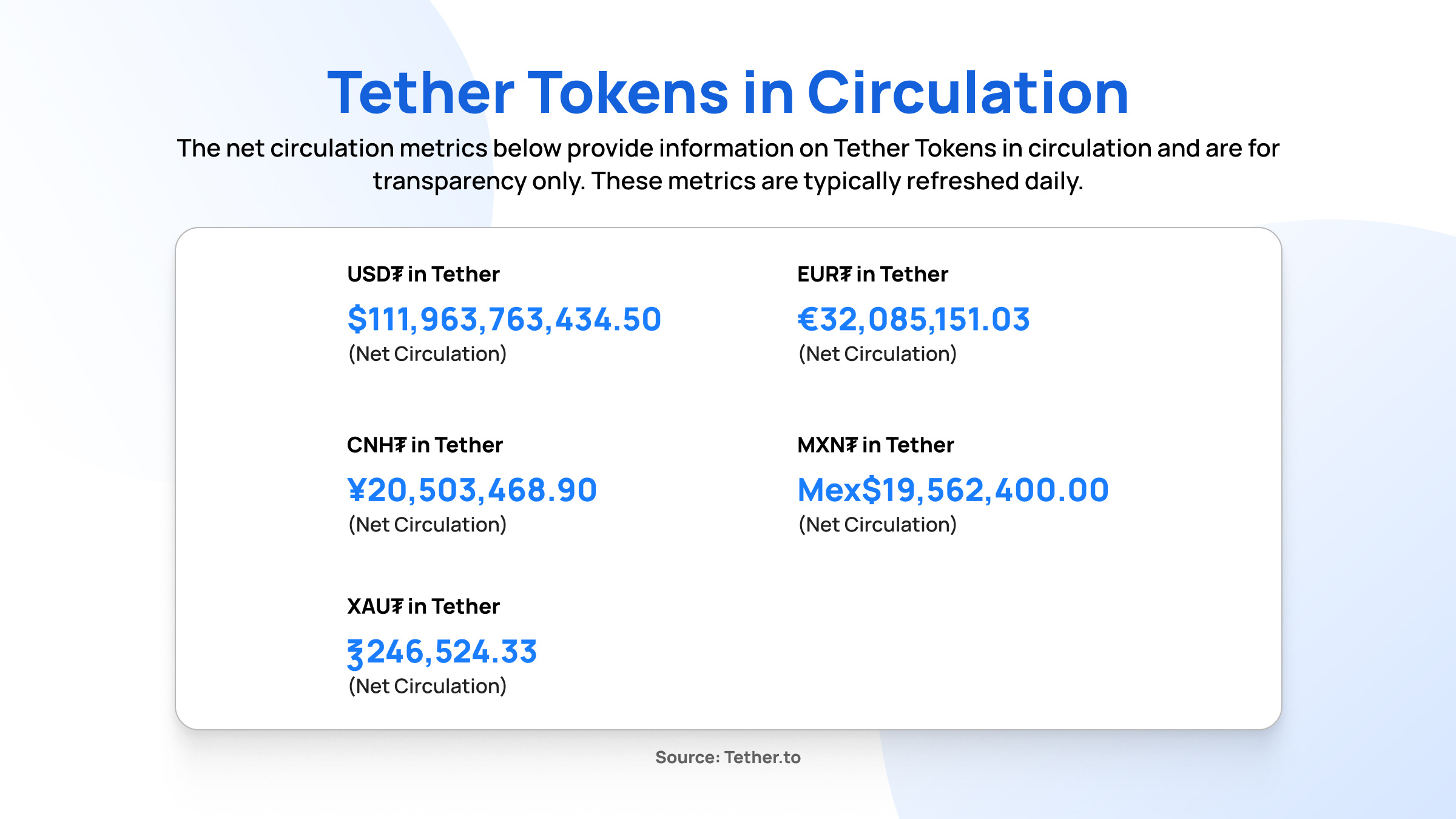

Along with U.S.-pegged tokens, Tether also issues stablecoins backed by other fiat currencies and commodities, such as the euro (EURT), offshore Chinese yuan (CNHT), Mexican peso (MXNT), and gold ( XAUT).

How Does Tether (USDT) Work?

The working of USDT involves the issuance and burning of tokens that are facilitated by the Tether platform in five steps such as:

- Step 1: A KYC-verified user, such as an individual trader, an exchange, or a business merchant, deposits fiat currencies like the U.S. dollar into Tether's official bank account.

- Step 2: Upon receiving the fiat currency deposit, Tether issues equivalent USDT tokens and delivers them directly to the user's provided wallet address after deducting the fees.

- Step 3: The USDT receivers use these stablecoins to trade, transfer, stake, or swap on various crypto platforms.

- Step 4: USDT holders can sell their tokens to redeem fiat currency via Tether's official website.

- Step 5: Tether removes the USDT tokens from circulation and sends equivalent fiat currencies to the user's bank account.

Tether is the only party that systematically issues and burns USDT tokens to ensure that each of their stablecoins is valued at $1.

History of USDT

- October 2014: Brock Pierce, Craig Sellars, and Reeve Collins originally launched USDT as Realcoin.

- November 2014: Reeve Collins, Tether CEO, renamed Realcoin to Tether (USDT).

- January 2015: Bitfinex exchange becomes the first platform to list USDT for trading.

- November 2017: Tether tokens worth around $31 million were stolen following a hack.

- September 2018: Tether's market cap crossed above $2.8 billion.

- October 2018: The price of USDT fell to $0.88 for a brief period as traders sold off Tether tokens, worried about a circulated credit risk.

- April 2019: A court order was issued against Bitfinex and Tether Limited for covering up the loss of $850 million.

- July 2020: The market cap of Tether tokens crosses $10 billion.

- February 2021: Bitfinex and Tether Limited agreed to pay a $18.5 million penalty on the case regarding the $850 million loss coverup.

- April 2021: USDT surpasses $50 billion market cap.

- May 2022: USDT dropped 5% to $0.95 for hours due to the negative sentiments in the market following the TerraUSD crash.

- November 2022: Tether freezes FTX-owned USDT tokens worth over $46 million following the law enforcement request.

- March 2024: USDT crosses $100 billion market cap.

Tether’s Reserves & Transparency Policies

The Commodity Futures Trading Commission (CFTC) issued an order on October 15, 2021, filing charges against Tether and Bitfinex for making misleading statements since their launch in 2014. According to the CFTC, Tether's claim of being a stablecoin backed by U.S. dollar reserves was untrue, violating the Commodity Exchange Act (CEA) and CFTC regulations.

Following this finding, the CFTC ordered Tether to pay $41 million as a penalty for false claims. Along with Tether, Bitfinex was also ordered to pay a $1.5 million penalty for conducting illegal transactions on its trading platform.

The penalty for Tether resulted from the CFTC's finding that this stablecoin platform misrepresented the market and its customers at least from June 1, 2016, to February 25, 2019. The commission found that Tether didn't maintain full reserves for the majority of the period.

CFTC also took a sample period of 26 months from 2016 to 2018 to check Tether's fiat reserve at that duration. The commission also found that Tether only backed 27.6% of the circulating USDT tokens during that period.

At present, USDT reserves are regularly updated on Tether's official website, which is accessible to everyone. Along with USDT, Tether's other stablecoins, such as Mexican peso (MXNT), gold (XAUT), offshore Chinese yuan (CNHT), and euro (EURT), also maintain their online reserve status.

Tether also publishes its reserve reports on its website, prepared by an independent third-party accounting firm, BDO Italia. These reports are published quarterly and can be viewed or downloaded by the public.

Advantages of Tether Tokens

Some of the potential advantages of USDT include:

- Stability: As USDT is pegged to the U.S. dollar, the value of this stablecoin is expected to remain near $1 in most situations.

- High Liquidity: Tether tokens are widely accepted cryptocurrencies and are available on all major exchanges, making them one of the most liquid tokens in the crypto ecosystem.

- Global Accessibility: Unlike traditional fiat currency, USDT allows users to facilitate borderless transactions without any additional charges or time delays.

- Low Fees: As USDT falls under the stablecoins category, most exchanges charge very low fees for exchanging or sending Tether tokens allowing budget-friendly transactions for traders and investors.

- Smoother Integration: The increasing adoption of USDT has facilitated effortless integration with crypto platforms, wallets, and dApps, enabling faster options like payment, staking, and more.

Major Controversies Associated with USDT

Tether has faced numerous controversies and allegations over the years. We'll take a look at the significant ones based on the February 23, 2021, press release report of the New York Attorney General (NYAG) on:

Case 1: Lack of Fiat Currency-Backed Assets

The investigation conducted by the Office of the Attorney General (OAG) found that Tether's statements on its asset reserves were false. OAG's major shocking finding was that Tether tokens had no banking partners to keep the reserve assets for backing its U.S. dollar-pegged stablecoin, USDT.

Following the OAG's findings related to USDT's lack of reserves, both Tether and Bitfinex were mandated to report their core business functions in the future. Tether was also informed to offer public disclosures related to its reserve assets, including the revelation of all receivables and loans to or from other affiliated entities.

Case 2: Lost Fund Cover Up

The NYAG conducted an inquiry involving Tether and Bitfinex that lasted over 22 months. This legal case examined the coverup associated with the loss of $850 million in corporate and customer funds between 2017 and 2018.

Based on the terms of the settlement proposed by the NYAG in February 2021, Tether and Bitfinex were asked to pay $18.5 million. In addition, Tether was obligated to provide its asset reserve for the upcoming two years.

Conclusion

Tether (USDT) is undoubtedly the most popular stablecoin in the crypto market. Holding USDT tokens instead of other volatile cryptocurrencies during a bear market can safeguard your investment portfolio against a high-value drop.

Despite the allegations and controversies that Tether has faced, this stablecoin's market cap continues to grow fast. The introduction of transparently publishing reserve reports and asset backup will help Tether tokens gain investors' trust over time.